Are you thinking about invest in real estate but feel overwhelmed by the options and considerations in today’s market? Fear not! In this blog post, we’ll guide you through the crucial aspects to consider to secure a smart and profitable real estate investment.

Target High-Value Opportunities

Currently, the trend among investors leans towards properties with significant future potential, rather than those in the lower price bracket of 1-2 crore rupees. Aim for properties that sell for around 20-25 thousand rupees per square foot, which show signs of substantial appreciation and robust end-user demand.

Building Trust with New Developers

It’s common for investors to feel apprehensive about entrusting their funds to new developers. However, every established developer was once a newcomer. The focus should be on the potential and strategic positioning of the developer rather than their historical track record. A promising developer offering competitive pricing to carve out a market niche could represent a valuable investment.

Maximize Returns through Financial Leverage

One of the golden rules in real estate investment is to leverage other people’s money. Avoid tying up your own capital directly in real estate; instead, utilize loans and investment partnerships. This approach allows your own funds to remain liquid for other investments, maximizing overall returns.

Advantages of Attractive Payment Plans

Seek out developers offering flexible payment structures, such as the 40:30:30 or 35:35:30 plans. These plans require minimal initial investment, with significant payment holidays that allow the property value to appreciate during the construction phase, enhancing your investment leverage.

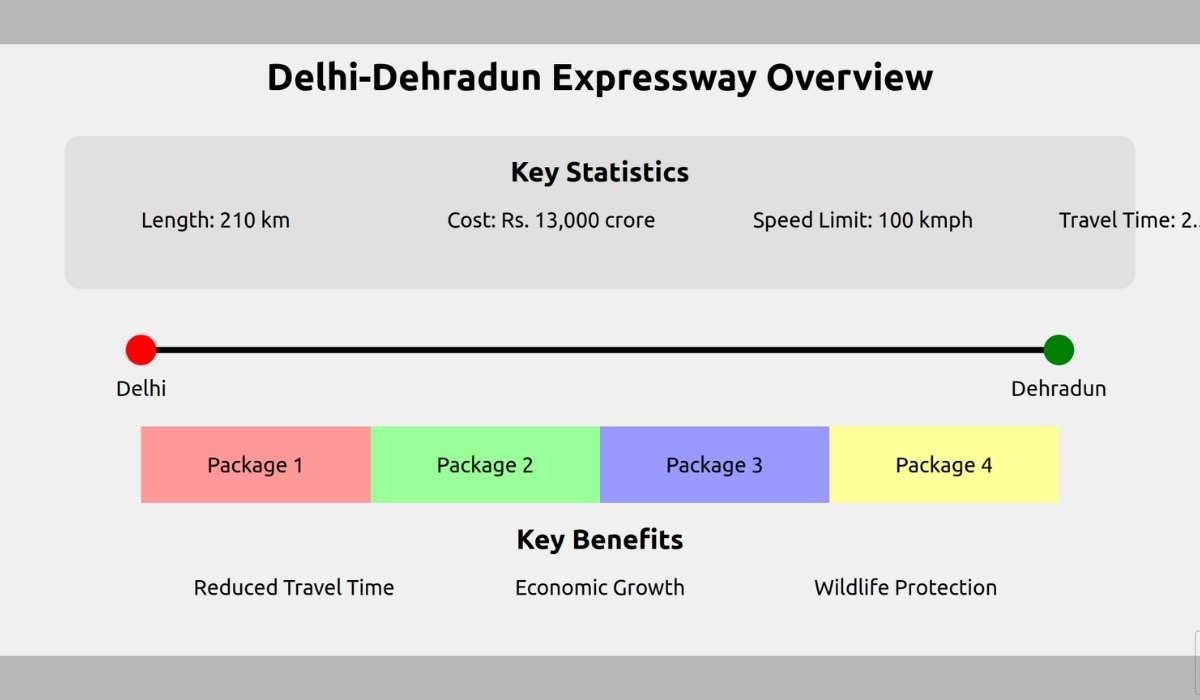

Choosing the Right Location and Amenities

The location of your investment plays a pivotal role in its future valuation. For instance, properties in upcoming areas like New Gurgaon are currently priced between 14,000-16,000 rupees per square foot, whereas more developed regions like Kareesumi are reaching up to 25,000 rupees per square foot. Additionally, properties with excellent amenities and thoughtful layouts are more likely to attract end-users, boosting the investment’s value.

Unlock Your Dream Home Today!

Get personalized real estate insights delivered straight to your inbox.

Evaluating Demand and Strategic Development

Before committing to an investment, assess the area’s growth potential and demand forecasts. Consider the type of buyers interested in the area and the expected price appreciation. Investments in regions with clear developmental plans and high end-user interest tend to offer better returns.

Diversify to Manage Risk

Do not concentrate all your resources in a single project. Diversify your investments across different properties and developers to balance risks and ensure a resilient investment portfolio. This strategy helps mitigate potential losses and secures a more stable financial future.

Partner with Expert Real Estate Consultants

Align yourself with reputable real estate advisors who can offer valuable market insights and investment guidance. A reliable partner will support you through the entire investment process, from selecting the right property to managing post-purchase requirements.

Conclusion

Investing in real estate offers lucrative opportunities, especially when approached with a strategic mindset. By focusing on high-value properties, leveraging financial tools, choosing strategic locations, and diversifying your investments, you can optimize your returns and secure a profitable investment portfolio in the real estate market.

Remember: Real estate is a long-term investment. Patience, research, and strategic planning are key to success.

Aim for properties with significant future potential, ideally priced around 20-25 thousand rupees per square foot, which show signs of substantial appreciation and robust end-user demand.

Yes, focus on the potential and strategic positioning of the developer rather than their historical track record. Many established developers started as newcomers.

Leverage other people’s money by using loans and investment partnerships, which allows your own funds to remain liquid for other investments.

Flexible payment structures, like 40:30:30 or 35:35:30 plans, require minimal initial investment and allow property values to appreciate during the construction phase.

The location of your investment significantly influences its future valuation. Properties in upcoming areas tend to appreciate more than those in already developed regions.

Evaluate the area’s demand forecasts, the type of buyers interested, and the expected price appreciation based on clear developmental plans.

Yes, diversifying across different properties and developers helps manage risk and creates a more resilient investment portfolio.

Reputable real estate advisors provide valuable market insights and investment guidance, assisting you through the entire investment process.

Patience, research, and strategic planning are essential for success, as real estate is a long-term investment.

Properties with excellent amenities and thoughtful layouts are more likely to attract end-users, which can increase the investment’s overall value.

DISCLAIMER

The information provided on this website is for general informational purposes only. While we strive to keep the content up-to-date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information, products, services, or related graphics contained on this website.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Real Estate Investment Risks

Real estate investments involve significant risks and market volatility. Property values, rental rates, and market conditions can fluctuate. Past performance is not indicative of future results.

Before Making Real Estate Decisions

Before making any real estate decision, we strongly advise you to:

- Conduct thorough due diligence

- Consult with qualified legal, financial, and real estate professionals

- Carefully review all relevant documents and contracts

- Consider your personal financial situation and investment goals

This website does not provide legal, financial, or investment advice. All content is for informational purposes only and should not be construed as professional advice or recommendations.

By using this website, you acknowledge and agree to these terms. We reserve the right to modify this disclaimer at any time without notice.