JP Group real estate once dominated the Indian property market, but its journey from glory to downfall offers a compelling case study for investors and industry observers alike. In the early 2000s, the mere announcement of a JP Group project would trigger a buying frenzy, with developments selling out within days. Their townships became synonymous with luxury living, and investing in a JP property was a badge of prestige.

However, the meteoric rise of JP Group real estate was followed by an equally dramatic fall, leaving thousands of homebuyers in limbo and billions of dollars in debt. This article delves deep into the captivating story of JP Group’s real estate ventures, exploring the factors that propelled their ascent, the missteps that led to their downfall, and the valuable lessons every real estate investor should heed.

From ambitious expressways to Formula 1 racing tracks, from sprawling townships to mounting debts, the JP Group real estate saga is a rollercoaster ride through the high-stakes world of Indian property development. Join us as we unravel the complex web of events that transformed JP Group from a symbol of success to a stark reminder of the pitfalls in aggressive expansion.

Whether you’re a seasoned real estate investor, a curious homebuyer, or simply intrigued by corporate sagas, this exploration of JP Group real estate’s rise and fall offers invaluable insights into the volatile nature of the property market. Buckle up as we embark on this journey through triumph, turbulence, and the ultimate test of corporate resilience in the real estate sector.

The Genesis of a Real Estate Giant

Founded in 1967 by Mr. Jayprakash Gaur, the JP Group’s journey began with humble origins in civil engineering and construction. By the early 2000s, JP Group real estate had become a significant player in the Indian property market, transforming into a diversified conglomerate with interests in various sectors.

- Cement manufacturing

- Hydropower generation

- Real estate development

- Sports ventures

- Infrastructure projects

The group’s expansion was so impressive that Forbes magazine recognized Mr. Jayprakash Gaur as the 48th richest person in India, with an estimated wealth of $1.5 billion in 2010.

Unlock Your Dream Home Today!

Get personalized real estate insights delivered straight to your inbox.

The Real Estate Boom: JP Group Real Estate’s Golden Era

In the early 2000s, JP Group real estate emerged as a leading player in India’s infrastructure development. Led by Mr. Manoj Gaur, son of Mr. Jayprakash Gaur, the company set its sights on the lucrative Noida, Greater Noida, and Yamuna Expressway regions.

Key Milestones:

- Land Acquisition Strategy: The Uttar Pradesh government offered land at significantly reduced prices – just 30% of its actual value – on a 99-year lease basis.

- Yamuna Expressway Concession Agreement (2003): This landmark deal granted JP Group rights to develop over 2,500 hectares of land in exchange for building the Yamuna Expressway.

- Massive Township Projects: JP Group launched four significant residential townships:

| Project Name | Location | Land Area (Acres) | Key Features |

|---|---|---|---|

| JP Greens | Greater Noida | 452 | Luxury residential units, golf course |

| JP Wishtown | Greater Noida | 1,063 | Apartments, schools, hospitals |

| JP Sports City | Greater Noida | 4,500 | Sports facilities, residential units |

| JP Greens | Agra | Not specified | Residential units, luxury amenities |

| Budh International Circuit | Greater Noida | 874 | India’s only Formula 1 level racing track |

Scale of Investment:

The total value of these projects in today’s market exceeds ₹1 lakh crores (approximately $12 billion).

Ambitious Offerings:

The projects promised:

- 32,000 apartments

- Plots and villas

- Hospitals and schools

- Two international-level golf courses

The Yamuna Expressway: A Marvel of Infrastructure

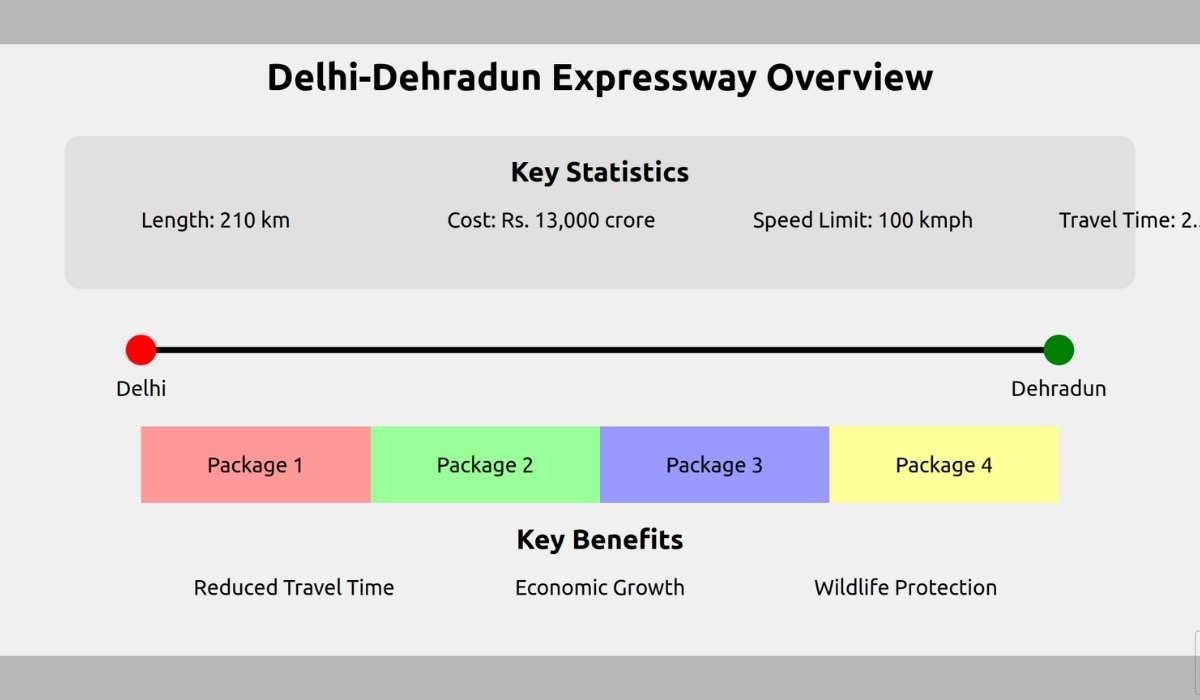

The Yamuna Expressway stands as a testament to JP Group’s ambition and capabilities:

- Total Cost: ₹13,000 crores (over $2.5 billion in 2012)

- Impact: Set a new standard for Indian infrastructure

JP Group’s Land Holdings

| Project | Land Area (Acres) |

|---|---|

| JP Greens (Greater Noida) | 452 |

| JP Wishtown | 1,063 |

| JP Sports City | 4,500 |

| JP Greens (Agra) | Not specified |

| Budh International Circuit | 874 |

| Total | Over 6,500 acres |

This extensive land bank positioned JP Group as one of India’s largest landholders, promising a bright future in real estate development.

The Turning Point: When JP Group Real Estate Dreams Began to Crumble

Despite the impressive growth and ambitious projects, the JP Group real estate empire began to show cracks. Between 2006 and 2012, the company embarked on an aggressive expansion strategy, investing a staggering 60,000 crores across various sectors. However, this rapid expansion sowed the seeds of future troubles.

Five Key Factors Contributing to JP Group’s Downfall:

- Delayed Land Acquisition:

- The Yamuna Expressway project faced a two-year delay in land acquisition.

- Result: Significant loss in expected revenue.

- Economic Crisis Impact:

- The global financial crisis hit the Indian real estate market hard.

- Consequences: Low sales and poor cash flow.

- Over-reliance on Loans:

- With 80-90% of payments already collected from homebuyers and new sales drying up, JP turned to heavy borrowing.

- Major lenders: ICICI Bank and State Bank of India (SBI).

- Political Challenges:

- JP Group’s close ties with the Mayawati-led Uttar Pradesh government backfired when power shifted.

- The new Samajwadi Party government created hurdles for JP’s projects.

- Unprofitable Investments:

- The Budh International Circuit, while prestigious, failed to deliver expected returns.

- Suspicions arose about fund diversion from residential projects to the racing circuit.

Additional Setbacks:

- Natural Disasters: The 2013 Uttarakhand floods severely damaged JP Group’s hydropower projects, adding to financial strains.

- Construction Delays: By 2015, most of JP’s real estate developments had stalled or shown little progress.

The Toll on Homebuyers

The real victims of JP Group’s financial troubles were the thousands of homebuyers who had invested their life savings in the promise of dream homes.

Promised vs. Delivered Units

| Metric | Number of Units |

|---|---|

| Promised Units | 32,000 |

| Delivered Units | Approximately 20,000 |

| Undelivered Units | Around 12,000 |

Many buyers faced a double financial burden:

- Paying EMIs on home loans

- Simultaneously paying rent for temporary accommodations

Buyer Reactions:

- Regular protests at the developer’s offices

- Legal actions by frustrated buyers seeking justice

The Debt Spiral and Bankruptcy Proceedings

By 2017, the JP Group’s financial situation had become dire:

- Total Debt: Nearly ₹30,000 crores

- RBI Action: Listed among 26 major loan defaulters in August 2017

Bank Actions:

| Creditor | Amount (in Crores) |

|---|---|

| 22 Banks | Over 29,000 |

| Yamuna Expressway Industrial Development Authority (YIDA) | 1,600 |

- ICICI Bank filed an insolvency petition in 2018

- SBI reported a default of ₹6,893 crores in 2022

Legal Battles and Acquisition Attempts

The JP Group’s financial troubles led to a complex series of legal and corporate maneuvers:

- NCLT Proceedings: The matter escalated to the National Company Law Tribunal.

- Multiple Bidding Rounds: Several companies vied to acquire JP Infratech Limited.

- Supreme Court Intervention: In March 2021, the court ordered a fresh bidding round.

- Final Outcome: Suraksha Group emerged victorious with 98.66% of the votes.

The Road to Recovery: Suraksha Group’s Acquisition

In March 2023, the NCLT approved Suraksha Group’s acquisition bid, marking a potential turning point for the beleaguered projects:

- Construction Plans: Suraksha Group aims to deliver all remaining units by December 2027.

- Compensation: The group agreed to pay lenders and YIDA for farmers’ compensation.

- Future Outlook: The success of this acquisition depends on Suraksha Group’s ability to deliver quality construction and regain market trust.

Key Lessons for Real Estate Investors from the JP Group Real Estate Saga

The JP Group saga offers valuable insights for anyone involved in real estate investment:

1. Beware of Aggressive Expansion:

- Rapid growth across multiple sectors can lead to unsustainable debt.

- Investor Tip: Exercise caution when developers pursue ambitious expansion strategies.

2. Understand Project Financing:

- Fund diversion from construction to other ventures can significantly delay projects.

- Investor Tip: Stay vigilant about developers’ financial strategies and project-specific fund allocation.

3. Look Beyond Reputation:

- A prestigious brand name doesn’t guarantee project success.

- Investor Tip: Assess each project on its own merits, considering the developer’s current financial health and plan feasibility.

4. Political Connections are Double-Edged:

- Over-reliance on political affiliations can backfire when power shifts.

- Investor Tip: Evaluate projects based on their inherent value, not political patronage.

The rise and fall of JP Group’s real estate empire serves as a stark reminder of the volatile nature of the industry. From being synonymous with luxury and prestige to becoming a cautionary tale, JP Group real estate’s journey offers invaluable lessons for developers, investors, and homebuyers alike.

FAQs

1. What led to the downfall of JP Group?

JP Group’s downfall can be attributed to a combination of delayed land acquisition, the impact of the global economic crisis, over-reliance on loans, political challenges, and unprofitable investments like the Budh International Circuit.

2. How did JP Group’s financial troubles affect homebuyers?

Thousands of homebuyers were left in limbo as JP Group failed to deliver promised units. Many faced financial strain due to ongoing EMIs on home loans and the need to pay rent for temporary accommodations.

3. What is the current status of JP Group’s projects?

As of March 2023, Suraksha Group has acquired JP Infratech Limited and plans to deliver all remaining units by December 2027. The success of this plan will depend on the group’s ability to execute quality construction and rebuild trust.

4. What lessons can real estate investors learn from JP Group’s story?

Investors should be cautious of developers pursuing aggressive expansion, stay informed about project financing, and not rely solely on a developer’s reputation. It’s also crucial to consider the potential risks of political affiliations.

5. What impact did the Budh International Circuit have on JP Group?

The Budh International Circuit, while prestigious, failed to deliver expected financial returns. Suspicions arose that funds intended for residential projects were diverted to support this unprofitable venture, contributing to JP Group’s financial troubles.

JP Group's downfall can be attributed to a combination of delayed land acquisition, the impact of the global economic crisis, over-reliance on loans, political challenges, and unprofitable investments like the Budh International Circuit.

Thousands of homebuyers were left in limbo as JP Group failed to deliver promised units. Many faced financial strain due to ongoing EMIs on home loans and the need to pay rent for temporary accommodations.

As of March 2023, Suraksha Group has acquired JP Infratech Limited and plans to deliver all remaining units by December 2027. The success of this plan will depend on the group's ability to execute quality construction and rebuild trust.

Investors should be cautious of developers pursuing aggressive expansion, stay informed about project financing, and not rely solely on a developer's reputation. It's also crucial to consider the potential risks of political affiliations.

The Budh International Circuit, while prestigious, failed to deliver expected financial returns. Suspicions arose that funds intended for residential projects were diverted to support this unprofitable venture, contributing to JP Group's financial troubles.

JP Group was founded in 1967 by Mr. Jayprakash Gaur, starting with humble origins in civil engineering and construction.

Significant projects included JP Greens in Greater Noida, JP Wishtown, JP Sports City, and the Budh International Circuit, among others.

JP Group faced nearly ₹30,000 crores in debt, significant losses from delayed projects, and a reliance on loans due to poor cash flow.

JP Group's close ties with the previous government backfired when power shifted, leading to hurdles in project approvals and execution under the new administration.

The Suraksha Group aims to deliver all remaining units by December 2027 and has committed to compensating lenders and farmers affected by the projects.

JP Group's downfall can be attributed to a combination of delayed land acquisition, the impact of the global economic crisis, over-reliance on loans, political challenges, and unprofitable investments like the Budh International Circuit.

Thousands of homebuyers were left in limbo as JP Group failed to deliver promised units. Many faced financial strain due to ongoing EMIs on home loans and the need to pay rent for temporary accommodations.

As of March 2023, Suraksha Group has acquired JP Infratech Limited and plans to deliver all remaining units by December 2027. The success of this plan will depend on the group's ability to execute quality construction and rebuild trust.

Investors should be cautious of developers pursuing aggressive expansion, stay informed about project financing, and not rely solely on a developer's reputation. It's also crucial to consider the potential risks of political affiliations.

The Budh International Circuit, while prestigious, failed to deliver expected financial returns. Suspicions arose that funds intended for residential projects were diverted to support this unprofitable venture, contributing to JP Group's financial troubles.

Key milestones included a strategic land acquisition at reduced prices, the Yamuna Expressway Concession Agreement in 2003, and the launch of several significant residential townships, which positioned JP Group as a major player in real estate.

The global financial crisis resulted in low sales and poor cash flow, severely impacting JP Group's ability to sustain its ambitious projects and leading to increased financial strain.

JP Group's close ties with the Mayawati-led Uttar Pradesh government backfired when the political power shifted, leading to new hurdles for the company's ongoing projects.

By 2017, JP Group's total debt had reached nearly ₹30,000 crores, which made it one of the major loan defaulters in India.

Suraksha Group aims to deliver all remaining units by December 2027 and has agreed to pay compensation to lenders and farmers affected by the projects.

DISCLAIMER

The information provided on this website is for general informational purposes only. While we strive to keep the content up-to-date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information, products, services, or related graphics contained on this website.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Real Estate Investment Risks

Real estate investments involve significant risks and market volatility. Property values, rental rates, and market conditions can fluctuate. Past performance is not indicative of future results.

Before Making Real Estate Decisions

Before making any real estate decision, we strongly advise you to:

- Conduct thorough due diligence

- Consult with qualified legal, financial, and real estate professionals

- Carefully review all relevant documents and contracts

- Consider your personal financial situation and investment goals

This website does not provide legal, financial, or investment advice. All content is for informational purposes only and should not be construed as professional advice or recommendations.

By using this website, you acknowledge and agree to these terms. We reserve the right to modify this disclaimer at any time without notice.