Are you an NRI dreaming of owning property in your homeland? Navigating the complex world of RBI guidelines for NRI real estate investment in India can feel like solving a Rubik’s cube blindfolded. But fear not! This comprehensive guide will illuminate the path to your Indian real estate dreams, ensuring you stay compliant while maximizing your investment potential.

The NRI Real Estate Investment Landscape in India

Before we dive into the nitty-gritty of RBI guidelines, let’s explore why India’s real estate market is a goldmine for NRIs:

- High ROI Potential: Major cities like Mumbai, Bangalore, Pune, Hyderabad, and Delhi-NCR offer robust returns on investment.

- Emotional Connect: Owning a piece of your homeland provides a sense of belonging and security.

- Diversification: Real estate balances your investment portfolio, mitigating risks in other asset classes.

- Favorable Exchange Rates: Strategic timing can lead to substantial savings and higher returns.

- Rapid Urbanization: India’s growing urban population drives demand for quality housing and commercial spaces.

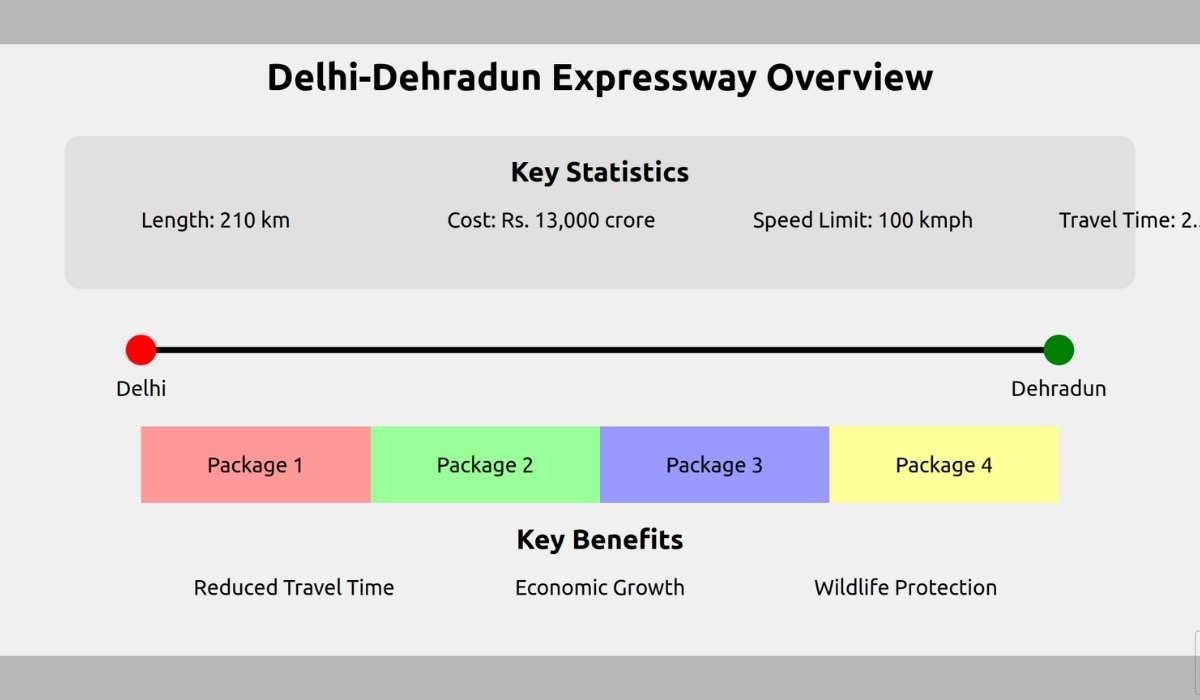

- Infrastructure Development: Ongoing and planned infrastructure projects enhance property values in many regions.

Understanding RBI Guidelines: Your Roadmap to Compliance

1. Eligible Properties

The Reserve Bank of India (RBI) allows NRIs to invest in:

- Residential properties

- Commercial properties

- Under-construction projects

- Ready-to-move-in properties

However, be cautious! The following are generally off-limits:

- Agricultural land

- Plantation properties

- Farmhouses

2. Funding Sources: Show Me the Money!

When it comes to financing your Indian real estate dreams, the RBI provides clear pathways:

- NRE/NRO Accounts: Utilize funds from your Non-Resident External (NRE) or Non-Resident Ordinary (NRO) accounts.

- Normal Banking Channels: Transfer funds through approved banking routes.

- Home Loans: Many Indian banks offer special NRI home loan programs. Compare rates and eligibility criteria for the best deal.

Key Points on NRI Home Loans:

Unlock Your Dream Home Today!

Get personalized real estate insights delivered straight to your inbox.

- Loan amount typically up to 80% of property value

- Repayment tenure up to 30 years

- Interest rates may be slightly higher than resident Indian rates

- Income proof and credit score from country of residence often required

3. Repatriation Rules: Taking Your Profits Home

Good news! The RBI allows repatriation of sale proceeds, subject to certain conditions:

- Repatriate up to the amount initially invested

- Include capital gains, after fulfilling documentation requirements

- Adhere to FEMA (Foreign Exchange Management Act) regulations

Repatriation Limits:

- For NRE account holders: No limit on repatriation of sale proceeds

- For NRO account holders: Up to USD 1 million per financial year

4. Maximum Property Holdings: Sky’s the Limit?

While there’s no explicit cap on the number of properties an NRI can own, remember:

- Total investment should align with RBI guidelines

- Ensure compliance with overall investment limits

- Consider the practicality of managing multiple properties

5. Joint Ownership: Stronger Together

NRIs can engage in joint ownership with:

- Other NRIs

- Resident Indians

- Person of Indian Origin (PIO)

- Overseas Citizen of India (OCI)

Pro Tip: Consider the legal and financial implications before entering joint ownership agreements, especially regarding repatriation and tax liabilities.

Navigating the Documentation Maze

To ensure a smooth sailing through your NRI real estate investment in India, keep these documents handy:

- Copy of Indian passport and visa

- Work permit from your country of residence

- Most recent ITR (Income Tax Return)

- Pay slips from the last six months

- Property-related documents, including the title deed

- Power of Attorney (if applicable)

- PAN card or Form 60 (if PAN is not available)

- NRI status proof (NRE/NRO account statements)

- Address proof in the country of residence

Tax Implications: The Elephant in the Room

Understanding the tax landscape is crucial for optimizing your investment:

- Rental Income: Taxable under the Income Tax Act

- Standard deduction of 30% available on gross rental income

- Additional deductions for property tax and home loan interest

- Capital Gains: Subject to taxation based on ownership duration

- Short-term (held for less than 24 months): Taxed at regular income tax rates

- Long-term (held for 24 months or more): 20% tax with indexation benefits

- DTAA Benefits: Leverage Double Taxation Avoidance Agreements to reduce liabilities

- TDS on Property Sale: Buyer must deduct TDS when purchasing from an NRI seller

- 20% for long-term capital gains

- 30% for short-term capital gains

Bold Advice: Consult with tax experts familiar with both Indian and your country of residence’s tax laws.

Prohibited Transactions: The No-Go Zones

Steer clear of these restricted areas:

- Agricultural Land: Generally prohibited without specific permissions

- Plantation Properties: Off-limits for NRI purchase

- Farmhouses: Require special approvals

Exception: NRIs can inherit agricultural land but may need to sell it within a specified timeframe.

Legal Due Diligence: Your Shield Against Pitfalls

Before sealing the deal, ensure:

- Clear and marketable property titles

- Compliance with local regulations and zoning laws

- All necessary approvals and clearances are in place

- RERA (Real Estate Regulatory Authority) registration for under-construction projects

- No pending litigation or disputes related to the property

The Power of Professional Guidance

Given the complexities of RBI guidelines for NRI real estate investment in India, leverage expert assistance:

- Legal Advisors: Navigate property laws and regulations

- Financial Consultants: Optimize investment strategy and tax planning

- Real Estate Experts: Identify lucrative opportunities and market trends

- Property Management Services: For hassle-free maintenance and rental management

Emerging Trends in NRI Real Estate Investment

Stay ahead of the curve by understanding these emerging trends:

- Smart Homes: Growing demand for tech-integrated living spaces

- Green Buildings: Increasing focus on sustainable and eco-friendly properties

- Co-living Spaces: Rising popularity, especially in metro cities

- REITs (Real Estate Investment Trusts): New avenue for diversified real estate investment

- Luxury Properties: High-end developments attracting NRI investors

- Tier-2 and Tier-3 Cities: Emerging as attractive investment destinations

Future Outlook: The Road Ahead

As India’s economy continues to grow and urbanize, the landscape of NRI real estate investment in India evolves. Stay informed about:

- Emerging real estate hotspots

- Regulatory changes, including potential amendments to FEMA and RERA

- Market trends and forecasts

- Impact of global economic factors on Indian real estate

Key Takeaways: Your NRI Real Estate Investment Cheat Sheet

- Understand eligible property types and funding sources

- Familiarize yourself with repatriation rules and tax implications

- Conduct thorough legal due diligence

- Leverage professional expertise for optimal outcomes

- Stay updated on RBI guidelines and market trends

- Consider emerging trends and future growth areas

- Plan for long-term investment horizons for maximum benefits

FAQs: Your Burning Questions Answered

Are you ready to turn your Indian real estate dreams into reality? Armed with this knowledge of RBI guidelines for NRI real estate investment in India, you’re now equipped to make informed decisions and build a strong investment portfolio in your homeland.

Remember, while this guide provides a comprehensive overview, RBI guidelines can change. Always consult with legal and financial experts before making significant investment decisions. Your journey to owning a piece of India starts here – make it count!

NRIs can invest in residential properties, commercial properties, under-construction projects, and ready-to-move-in properties. However, they generally cannot invest in agricultural land, plantation properties, or farmhouses.

NRIs can finance their investments through NRE/NRO accounts, normal banking channels, or home loans provided by Indian banks. It's advisable to compare rates and eligibility criteria for the best deal.

NRIs can repatriate the amount initially invested, along with capital gains, after fulfilling documentation requirements. For NRE account holders, there is no limit on repatriation, while NRO account holders can repatriate up to USD 1 million per financial year.

There is no explicit cap on the number of properties an NRI can own; however, total investment should align with RBI guidelines and practicality in managing multiple properties should be considered.

Yes, NRIs can engage in joint ownership with other NRIs, resident Indians, Persons of Indian Origin (PIO), and Overseas Citizens of India (OCI). It is important to consider the legal and financial implications before entering such agreements.

NRIs should prepare a copy of their Indian passport and visa, work permit, recent income tax return, pay slips, property-related documents, power of attorney (if applicable), PAN card or Form 60, NRI status proof, and address proof in their country of residence.

Rental income is taxable under the Income Tax Act, with a standard deduction of 30% available on gross rental income, and additional deductions for property tax and home loan interest.

Yes, NRIs are generally prohibited from purchasing agricultural land, plantation properties, and farmhouses without special permissions. Inheriting agricultural land is allowed but may require selling it within a specified timeframe.

Professional advisors such as legal advisors, financial consultants, real estate experts, and property management services can help NRIs navigate property laws, optimize investment strategies, and manage properties effectively.

NRIs should pay attention to trends such as smart homes, green buildings, co-living spaces, REITs (Real Estate Investment Trusts), luxury properties, and the rising attractiveness of tier-2 and tier-3 cities for investments.

NRIs can invest in residential properties, commercial properties, under-construction projects, and ready-to-move-in properties. However, agricultural land, plantation properties, and farmhouses are generally off-limits.

NRIs can utilize funds from Non-Resident External (NRE) or Non-Resident Ordinary (NRO) accounts, transfer funds through approved banking channels, or avail home loans offered by Indian banks.

NRIs can repatriate sale proceeds up to the amount initially invested, including capital gains, after fulfilling documentation requirements. For NRE account holders, there is no limit on repatriation, while NRO account holders can repatriate up to USD 1 million per financial year.

There is no explicit cap on the number of properties an NRI can own, but total investments should align with RBI guidelines, and practicality in managing multiple properties should be considered.

Yes, NRIs can engage in joint ownership with other NRIs, Resident Indians, Persons of Indian Origin (PIO), and Overseas Citizens of India (OCI). It is advisable to consider legal and financial implications before entering such agreements.

Key documents include a copy of the Indian passport and visa, work permit, recent Income Tax Return (ITR), pay slips, property-related documents (title deed), Power of Attorney (if applicable), PAN card or Form 60, NRI status proof, and address proof in the country of residence.

Rental income is taxable under the Income Tax Act with a standard deduction of 30%. Capital gains tax applies based on ownership duration: short-term gains are taxed at regular rates, while long-term gains are taxed at 20% with indexation benefits.

NRIs are generally prohibited from purchasing agricultural land, plantation properties, and farmhouses without special permissions. However, NRIs can inherit agricultural land but may need to sell it within a specified timeframe.

NRIs should conduct thorough legal due diligence, ensuring clear property titles, compliance with local regulations, necessary approvals, and RERA registration for under-construction projects. It is advisable to consult legal advisors.

Emerging trends include demand for smart homes, green buildings, co-living spaces, REITs (Real Estate Investment Trusts), luxury properties, and opportunities in tier-2 and tier-3 cities.

DISCLAIMER

The information provided on this website is for general informational purposes only. While we strive to keep the content up-to-date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information, products, services, or related graphics contained on this website.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Real Estate Investment Risks

Real estate investments involve significant risks and market volatility. Property values, rental rates, and market conditions can fluctuate. Past performance is not indicative of future results.

Before Making Real Estate Decisions

Before making any real estate decision, we strongly advise you to:

- Conduct thorough due diligence

- Consult with qualified legal, financial, and real estate professionals

- Carefully review all relevant documents and contracts

- Consider your personal financial situation and investment goals

This website does not provide legal, financial, or investment advice. All content is for informational purposes only and should not be construed as professional advice or recommendations.

By using this website, you acknowledge and agree to these terms. We reserve the right to modify this disclaimer at any time without notice.