In the bustling city of Noida, the real estate market has been soaring, presenting lucrative opportunities for savvy investors. As the calendar flips to 2024, the prospects for real estate investment in Noida are more promising than ever. This comprehensive guide aims to equip you with the knowledge and strategies to navigate this thriving market successfully.

Over the past three years, real estate prices in Noida and Gurgaon have skyrocketed, making it increasingly challenging for many to afford properties. However, industry experts suggest that there is still ample potential for capital appreciation, with approximately 50-60% of the real estate cycle yet to be completed.

“Now, there is scope for more capital appreciation,” the expert reveals, highlighting the promising future of real estate investment in Noida.

While new investments in 2024 may not yield the three-fold returns witnessed in the past, strategic decision-making and prudent selection can unlock substantial growth opportunities.

Micro-Markets and Their Unique Stories

Every micro-market in Noida has its own narrative, shaping the trajectory of real estate investments. From the bustling SPR Road in Gurgaon to the Dwarka Expressway and the Global City CPR area, each location presents a distinct set of challenges and prospects.

In Noida, the Noida Expressway, Yamuna Expressway, and the emerging developments in Noida Extension each have their own stories to tell. Investors must carefully analyze these micro-markets and their unique dynamics to identify areas poised for growth and appreciation.

Choosing the Right Investment: Key Pointers

To maximize returns on your real estate investment in Noida, consider the following crucial pointers:

Unlock Your Dream Home Today!

Get personalized real estate insights delivered straight to your inbox.

- Holding Capacity: Commercial real estate investors should be prepared to hold their properties for at least 1-2 years after possession, while residential investors should aim for a holding period until possession in 2024.

- Developer Reputation: Avoid rookie developers with only their first or second project under their belt. Instead, prioritize investments with reputable, top-tier developers to mitigate risks.

- Premium Luxury Projects: Focus your investments on premium luxury projects, as premiumization will play a pivotal role in driving price appreciation in Noida’s real estate market.

Premiumization will play a huge role in increasing prices in real estate,” the expert emphasizes, underscoring the importance of investing in high-end, luxury properties.

The Premiumization Effect: A Case Study

Consider the example of Prestige, a renowned Bangalore-based developer, acquiring a massive 60-62 acre land parcel along NH24 in Siddharth Vihar. This upcoming township project, complete with residential plots, high-rise apartments, and commercial offerings, is set to redefine the area’s real estate landscape.

According to industry projections, the residential plots could launch at a staggering rate of ₹2.25 lakhs per gaj, catering to the region’s affluent residents seeking a premium lifestyle. Similarly, the high-rise apartments are expected to debut at around ₹14,000 per square foot, significantly impacting the resale values of nearby properties.

“You will see that all the apartments which are worth 9,000-9,500 per square feet in this location will be worth 11,000-11,500 per square feet as soon as the launch happens,” the expert predicts, highlighting the ripple effect of premiumization.

This trend is not limited to Noida alone. Across Gurgaon, Yamuna Expressway, and other emerging micro-markets, the influx of premium projects is driving up property values in surrounding areas, as buyers seek to upgrade their lifestyles and invest in better amenities.

Supply and Demand Dynamics

One of the key drivers of real estate appreciation in Noida is the limited supply of new projects amid surging demand. Many recent launches, such as Godrej Jardenia in Sector 146 and Experion in Sector 45, have been oversubscribed, leaving potential investors with limited options.

“Even today, if someone asks us for 3.5-3.5 crores in residential, we are not able to give them options,” the expert laments, highlighting the supply crunch in the high-end residential segment.

This imbalance between supply and demand is further exacerbated by the influx of buyers from Delhi, NRIs, and those seeking to upgrade their living standards, all contributing to the upward pressure on property prices.

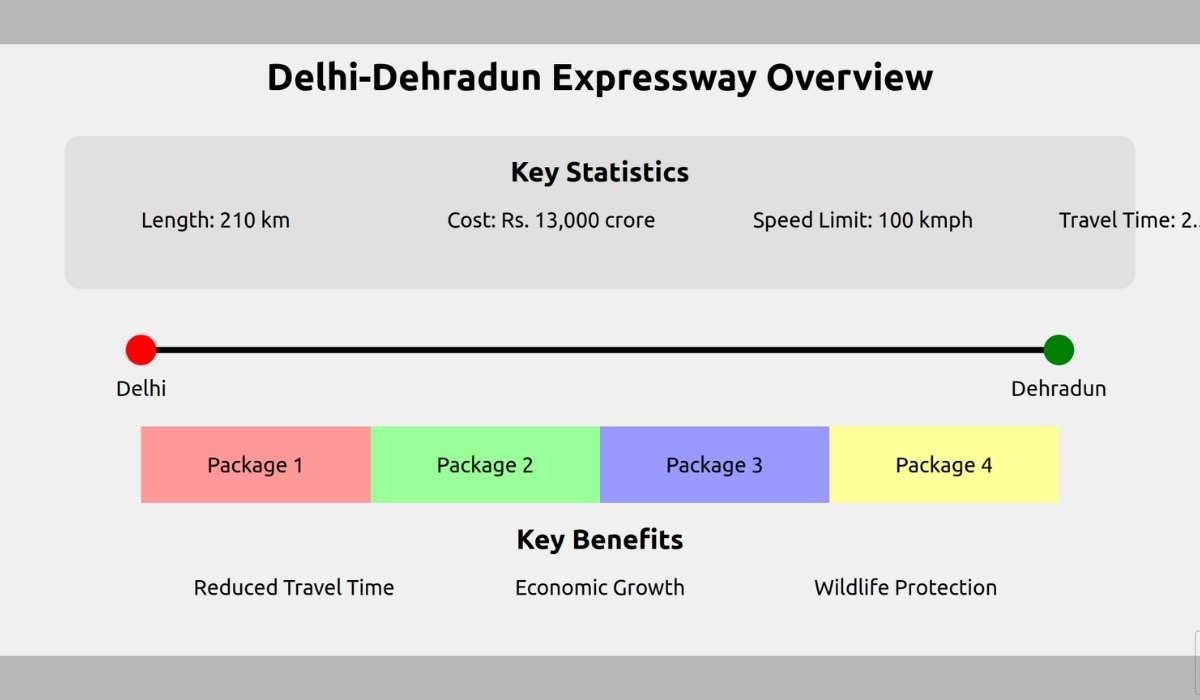

The Noida International Airport Effect

With the highly anticipated inauguration of the Noida International Airport slated for late 2024, the real estate market in Noida is poised for a significant boost. The improved connectivity and infrastructure developments are expected to drive demand and spur price appreciation across various micro-markets.

“At Yamuna Expressway, Noida International Airport, which is going to inaugurate at the end of this year, it will also have a lot of effect, prices will increase here,” the expert confirms, emphasizing the airport’s potential impact on real estate investment in Noida.

Resale and Rental Opportunities

For existing property owners in Noida, the expert advises against selling until the end of 2024, as the market is ripe for appreciation. Areas such as NS24, Siddharth Vihar, Indirapuram, and Vaishali are expected to witness significant price growth, presenting lucrative resale opportunities.

Additionally, the expert suggests exploring rental market dynamics, as rentals serve as an accurate barometer of demand. Investors are encouraged to consider the potential rental yields and cash flows when evaluating real estate investment in Noida.

Conclusion: Seizing the Moment

As the real estate market in Noida continues its upward trajectory, strategic investors have a unique opportunity to capitalize on the growth potential. By carefully analyzing micro-markets, focusing on premium luxury projects, and aligning investments with the market’s supply and demand dynamics, savvy investors can unlock substantial returns on their real estate investment in Noida.

Remember, success in this competitive landscape hinges on diligent research, prudent decision-making, and a commitment to staying informed about the ever-evolving market trends. With the right approach, your real estate investment in Noida could pave the way for long-term wealth creation and financial success.

Are you ready to embark on this exciting journey? Explore the possibilities, seize the opportunities, and unlock the full potential of real estate investment in Noida in 2024 and beyond.

The real estate market in Noida is witnessing significant growth, with a focus on premium luxury projects and a high demand due to limited supply. The market is expected to continue appreciating, especially with the upcoming Noida International Airport enhancing connectivity.

Each micro-market in Noida has its unique dynamics that influence property values and investment potential. Understanding these specific characteristics helps investors identify areas with the best opportunities for growth and appreciation.

Investors in commercial real estate should plan to hold properties for at least 1-2 years post-possession, while residential investors are encouraged to hold until possession in 2024 to maximize returns.

Investing with reputable, established developers reduces risks associated with new projects. It is advisable to avoid rookie developers with limited project history to ensure stability and reliability in investment.

Premiumization is a key factor driving price increases in Noida's real estate market. Investing in high-end luxury projects is expected to yield significant appreciation as demand for premium lifestyles rises.

The inauguration of the Noida International Airport in late 2024 is anticipated to boost property values due to improved connectivity and increased demand across various micro-markets in Noida.

Areas such as NS24, Siddharth Vihar, Indirapuram, and Vaishali are projected to experience substantial price appreciation, making them attractive options for resale and investment.

Investors should evaluate the rental market dynamics as they provide insights into demand. Exploring potential rental yields can enhance cash flow and overall investment strategy.

Important pointers include assessing holding capacity, choosing reputable developers, focusing on premium luxury projects, and analyzing micro-markets for growth potential.

It is advised against selling properties before the end of 2024, as the market is expected to appreciate significantly, providing better resale opportunities later.

DISCLAIMER

The information provided on this website is for general informational purposes only. While we strive to keep the content up-to-date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information, products, services, or related graphics contained on this website.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Real Estate Investment Risks

Real estate investments involve significant risks and market volatility. Property values, rental rates, and market conditions can fluctuate. Past performance is not indicative of future results.

Before Making Real Estate Decisions

Before making any real estate decision, we strongly advise you to:

- Conduct thorough due diligence

- Consult with qualified legal, financial, and real estate professionals

- Carefully review all relevant documents and contracts

- Consider your personal financial situation and investment goals

This website does not provide legal, financial, or investment advice. All content is for informational purposes only and should not be construed as professional advice or recommendations.

By using this website, you acknowledge and agree to these terms. We reserve the right to modify this disclaimer at any time without notice.