The Indian real estate market experienced a significant boom in housing sales during 2023, with strong performance across residential, commercial, office space, and retail sectors. As we move into 2024, it is crucial for end-users, first-time property buyers, and expert real estate investors to stay informed about the latest trends to identify the right opportunities and make sound investments. In this article, we will explore the Top 10 Indian Real Estate Trends

1. Continued Growth in the Real Estate Market

- According to the Concord Group, the Indian real estate market is projected to grow at a compounded annual growth rate (CAGR) of 9.2% between 2023 and 2028.

- While prices are expected to increase by 20-30% in 2024, historical data suggests that a period of stagnation may follow after 1-2 years of aggressive price growth.

- Investors with a long-term horizon and a holding period of 4-5 years are more likely to realize profitable returns on their investments.

2. Rising Demand for Luxury Housing

- The share of luxury housing in total residential sales has increased from 7% in 2019 to 18% in 2023.

- From 2024 to 2029, luxury housing sales are expected to grow at an annual rate of 22%, presenting a significant opportunity for investors.

- The luxury housing segment is less likely to experience stagnation compared to affordable and premium segments, making it an attractive option for investors.

3. 2024: A Seller’s Market

- The inventory of ready-to-move properties in the market is limited and relatively old, leading to high prices for resale properties.

- Many new projects launched after 2020 will be ready for possession from 2025 onwards, increasing the supply of resale properties and creating competition between resale and new launch properties.

- Investors looking to exit the market in early 2025 or 2026 may find favorable conditions to sell their properties at a profit.

4. Slowdown in the Rental Market

- After a period of rapid growth in the last 2 years, the rental market is expected to slow down in 2024, with some exceptions in certain locations.

- End-users may resist further rental price increases, leading to a more stagnant rental market.

- Investors who purchased properties between 2019 and 2023 can still expect to generate good rental income, but those investing in 2024-2025 may face challenges in achieving high rental yields.

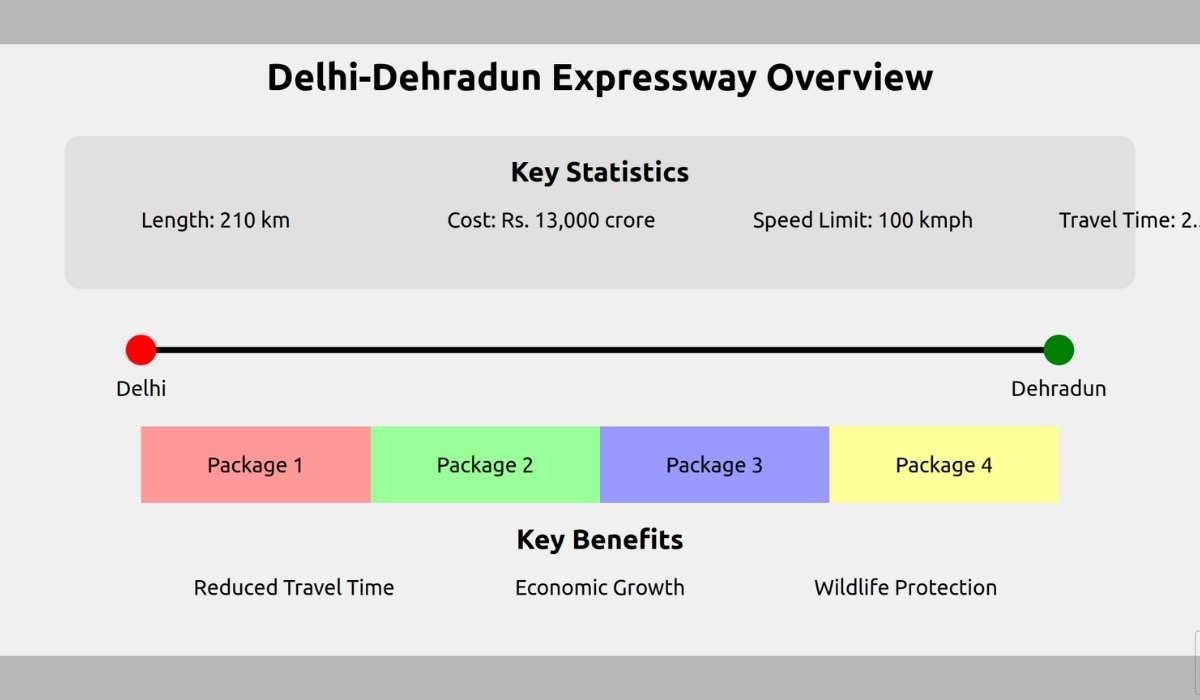

5. Increased Demand in Metro City Peripheries

- Demand for properties in developing and underdeveloped locations around metro cities is expected to rise rapidly in 2024.

- In 2023, demand in suburban areas around metro cities increased by 20%, driven by the affordability crisis in city centers and the desire for better amenities and living conditions.

- Investors should carefully evaluate the infrastructure development and government projects in these locations to identify the best investment opportunities.

6. Growth in Tier 2 and Tier 3 Cities

- Demand for housing in tier 2 and tier 3 cities is expected to continue its upward trend in 2024, supported by government initiatives such as smart city development and improved connectivity.

- Well-known developers are launching projects in these cities, providing investors with opportunities to capitalize on lower prices and potential rental income.

- Investors should conduct thorough due diligence and consider factors such as import/export activities and connectivity to metro cities when selecting tier 2 and tier 3 cities for investment.

7. Moderate Growth in Leasing Demand

- The leasing space is expected to experience slow growth in 2024 due to global economic and political factors, including elections in India and the United States.

- However, the commercial sector is likely to pick up pace after 2025, when market conditions are expected to normalize.

- Retail infrastructure may experience a boom in the coming years, particularly in areas with ongoing government projects such as airports, highways, and major infrastructure developments.

8. Rise of Co-Working Spaces

- As some companies continue to operate on hybrid or work-from-home models, the demand for co-working spaces is expected to increase in 2024.

- Co-working spaces that offer high-speed internet, a professional environment, and amenities that enhance productivity are likely to attract more users.

- Investors can consider acquiring office spaces or investing in co-working spaces to capitalize on this growing trend.

9. Smart Homes and Luxury Features

- While currently limited to a few projects, the demand for smart homes and luxury features is expected to increase in the future.

- Smart homes, which offer automated controls for various aspects of the home and enhanced security features, are becoming more attractive to tenants and buyers.

- Investing in properties with smart home features may provide a competitive edge in the rental market and attract premium buyers.

10. Growing Interest in Green Building Housing

- Energy-efficient and environmentally-friendly housing projects are gaining popularity, particularly in the luxury segment.

- Although currently limited, the demand for green homes is expected to increase gradually in the future.

- Luxury buyers are often willing to pay a premium for eco-friendly features, making green building housing an attractive investment opportunity.

In conclusion, the Indian real estate market is poised for growth in 2024, with various trends shaping the investment landscape. From the rising demand for luxury housing and the growth of tier 2 and tier 3 cities to the emergence of co-working spaces and smart homes, investors have a range of opportunities to explore. However, it is essential to keep a close eye on factors such as inflation rates, interest rates, and the global political and economic situation, as they can impact buyer sentiment and property prices. By staying informed and making data-driven decisions, investors can navigate the dynamic real estate market and identify the most promising opportunities in 2024 and beyond.

The Indian real estate market is projected to grow at a compounded annual growth rate (CAGR) of 9.2% between 2023 and 2028.

The share of luxury housing in total residential sales has increased from 7% in 2019 to 18% in 2023.

A limited inventory of ready-to-move properties and high prices for resale properties contribute to the expectation of a seller's market in 2024.

The rental market is expected to slow down in 2024, with some exceptions in certain locations.

Unlock Your Dream Home Today!

Get personalized real estate insights delivered straight to your inbox.

The demand is driven by the affordability crisis in city centers and the desire for better amenities and living conditions.

Demand for housing in tier 2 and tier 3 cities is expected to continue its upward trend, supported by government initiatives and improved connectivity.

Leasing demand is expected to experience slow growth in 2024 due to global economic and political factors.

The demand for co-working spaces is expected to increase as companies continue to adopt hybrid or work-from-home models.

There is a growing demand for smart homes and luxury features, such as automated controls and enhanced security.

Energy-efficient and environmentally-friendly housing projects are gaining popularity, especially among luxury buyers who are willing to pay a premium for eco-friendly features.

DISCLAIMER

The information provided on this website is for general informational purposes only. While we strive to keep the content up-to-date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information, products, services, or related graphics contained on this website.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Real Estate Investment Risks

Real estate investments involve significant risks and market volatility. Property values, rental rates, and market conditions can fluctuate. Past performance is not indicative of future results.

Before Making Real Estate Decisions

Before making any real estate decision, we strongly advise you to:

- Conduct thorough due diligence

- Consult with qualified legal, financial, and real estate professionals

- Carefully review all relevant documents and contracts

- Consider your personal financial situation and investment goals

This website does not provide legal, financial, or investment advice. All content is for informational purposes only and should not be construed as professional advice or recommendations.

By using this website, you acknowledge and agree to these terms. We reserve the right to modify this disclaimer at any time without notice.