India’s residential real estate market has shown remarkable resilience and growth in the first quarter of 2024, despite the challenges posed by inflation and monetary policy tightening globally. The sector has been on a steep recovery path since the pandemic, with positive homebuyer sentiments and a supportive economic environment driving market demand to successive highs.

In this article, we delve into the key findings of Knight Frank’s Q1 2024 report on India’s residential market performance and analyze the data presented by a real estate expert to provide a comprehensive overview of the current state of the market.

Residential Market Highlights

- Sales Volume: In Q1 2024, 86,345 residential units were sold across eight major cities, representing a 9% year-on-year (YoY) growth. Mumbai led the pack with 23,743 units sold, a 17% increase compared to the previous year.

- Launches: Residential development has been in overdrive, with the volume of units launched exceeding sales for the past six quarters. Kolkata saw the highest growth in units launched at 89% YoY, with 6,021 units coming online, a record high for the market.

- Ticket Size: The share of sales in the INR 10 million and above ticket-size grew significantly to 40% in Q1 2024, compared to 29% a year ago. This segment has been the primary driver for overall sales growth, with a 51% YoY increase.

- Prices: Price levels have grown in tandem with demand across all markets. Hyderabad saw the most significant rise at 13% YoY, as focus shifted toward the development of premium high-rise properties.

- Unsold Inventory: The unsold inventory level has increased by 4% YoY, as fresh development activity has intensified. However, the quarters-to-sell (QTS) level has improved to 5.9 quarters from 6.7 a year ago.

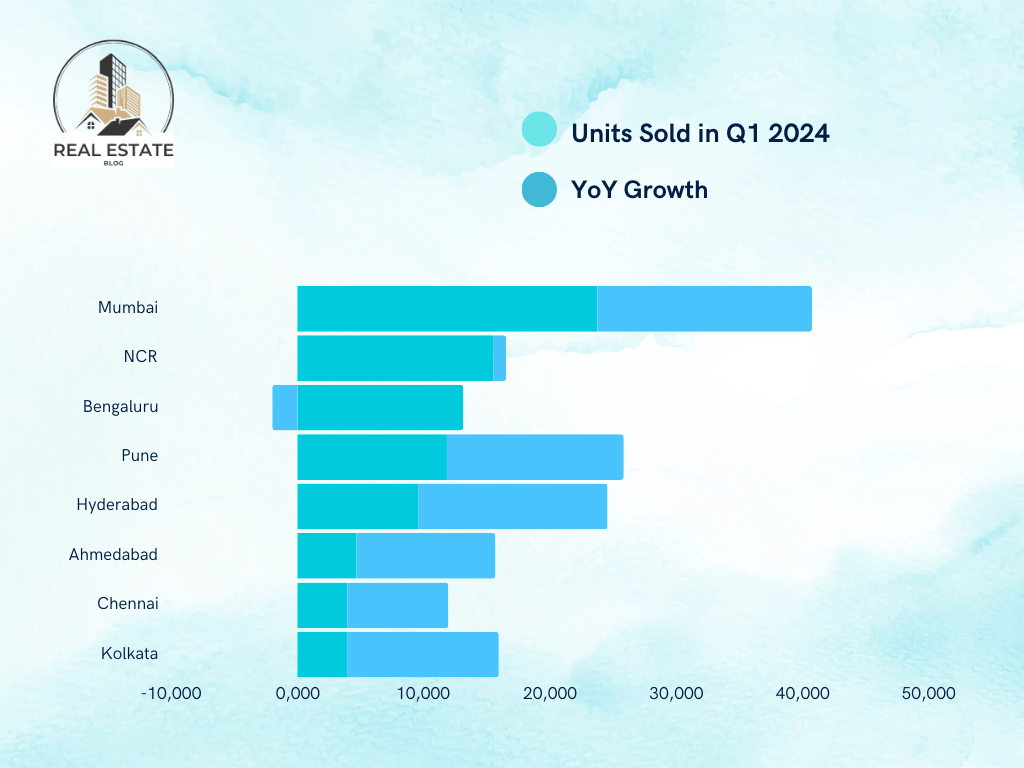

City-wise Sales Performance

| City | Units Sold in Q1 2024 | YoY Growth |

|---|---|---|

| Mumbai | 23,743 | 17% |

| NCR | 15,527 | 1% |

| Bengaluru | 13,133 | -2% |

| Pune | 11,832 | 14% |

| Hyderabad | 9,550 | 15% |

| Ahmedabad | 4,673 | 11% |

| Chennai | 3,950 | 8% |

| Kolkata | 3,937 | 12% |

Source: Knight Frank Research

As evident from the table above, Mumbai, Hyderabad, and Pune have been the top performers in terms of sales growth, while Bengaluru saw a marginal dip of 2% YoY.

Ticket Size Analysis

The residential real estate market in India has witnessed a significant shift in demand towards higher ticket sizes. The share of sales in the INR 10 million and above category has grown from 29% in Q1 2023 to 40% in Q1 2024, primarily driven by the need for larger living spaces and an upgraded lifestyle post-pandemic.

However, this growth in the premium segment has come at the expense of the mid-segment (INR 5-10 million) and affordable (<INR 5 million) categories, which have seen their market share drop by 5% and 5% YoY, respectively.

Unlock Your Dream Home Today!

Get personalized real estate insights delivered straight to your inbox.

Unsold Inventory and QTS

Despite the increase in unsold inventory levels by 4% YoY, the overall market health remains strong. The quarters-to-sell (QTS) level, which represents the number of quarters required to exhaust the existing unsold inventory at the current sales pace, has improved to 5.9 quarters from 6.7 a year ago.

| Ticket-size segment | Unsold Inventory (YoY change) | QTS |

|---|---|---|

| 0 – 5 mn | 199,121 (-8%) | 7.7 |

| 5 – 10 mn | 144,199 (2%) | 4.9 |

| >10 mn | 137,100 (33%) | 5.2 |

| Total | 480,420 (4%) | 5.9 |

Source: Knight Frank Research

The QTS levels for the mid and premium segments stand at a healthy 4.9 and 5.2 quarters, respectively, indicating a strong ability to move inventory, especially at the top-end of the market.

Analyzing the Expert’s Perspective

The real estate expert, analyzes the Q1 2024 performance report and shares his insights on the current state of the India residential real estate market .

Key takeaways from his analysis:

- Demand growth: The 9% YoY growth in sales volume indicates that demand has not decreased, and people are still positive about buying houses.

- Luxury housing demand: The market share of properties above INR 1 crore has increased from 29% to 40%, suggesting a growing appetite for luxury housing.

- New launches: Developers remain confident about the market, as evidenced by the 7% increase in new launches compared to the previous quarter.

- Price growth: While prices have increased between 5-13% YoY, the expert believes that developers are realizing that further price hikes may slow down sales.

- Unsold inventory: The increasing unsold inventory in the >INR 1 crore segment may lead to increased competition among developers and more offers and discounts in the coming quarters.

- Market stability: The expert opines that the market will remain stable, with prices growing in line with inflation rates. He does not foresee a crash in the near future, despite some concerns about the market being overheated.

Conclusion

The India residential real estate market has demonstrated strong growth and resilience in Q1 2024, driven by positive homebuyer sentiments and a supportive economic environment. While the premium segment has been the primary driver of growth, the overall market health remains strong, with improved QTS levels and a steady pipeline of new launches.

As we move forward, it will be essential to monitor the impact of the upcoming elections on new project launches and the potential challenges that may arise when the large volume of projects launched in the last 4 years near completion. However, for now, the market appears to be on a stable footing, with prices expected to grow in line with inflation rates.

For end-users, the expert suggests that if they find a suitable property within their budget, they should consider purchasing it, as prices are unlikely to decrease in the near future. Investors, on the other hand, may want to exercise caution and evaluate their long-term objectives, as the potential for short-term profits may be limited in the current market scenario.

In Q1 2024, 86,345 residential units were sold across eight major cities in India, representing a 9% year-on-year growth.

Mumbai led the sales with 23,743 units sold, marking a 17% increase compared to the previous year.

The market share of properties above INR 1 crore increased from 29% to 40%, indicating a growing appetite for luxury housing.

Residential development has been active, with new launches exceeding sales for the past six quarters, and Kolkata saw the highest growth in units launched at 89% YoY.

Price levels have grown across all markets, with Hyderabad seeing a significant rise of 13% year-on-year.

Unsold inventory levels increased by 4% YoY, but the quarters-to-sell (QTS) improved to 5.9 quarters from 6.7 a year ago.

The increasing unsold inventory in the luxury segment may lead to increased competition among developers and potentially more offers and discounts.

The mid-segment (INR 5-10 million) and affordable segment (<INR 5 million) have seen market share drops of 5% YoY.

The expert suggests that if end-users find a suitable property within their budget, they should consider purchasing it, as prices are unlikely to decrease in the near future.

The expert believes the market will remain stable, with prices growing in line with inflation rates, and does not foresee a crash in the near future.

DISCLAIMER

The information provided on this website is for general informational purposes only. While we strive to keep the content up-to-date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information, products, services, or related graphics contained on this website.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Real Estate Investment Risks

Real estate investments involve significant risks and market volatility. Property values, rental rates, and market conditions can fluctuate. Past performance is not indicative of future results.

Before Making Real Estate Decisions

Before making any real estate decision, we strongly advise you to:

- Conduct thorough due diligence

- Consult with qualified legal, financial, and real estate professionals

- Carefully review all relevant documents and contracts

- Consider your personal financial situation and investment goals

This website does not provide legal, financial, or investment advice. All content is for informational purposes only and should not be construed as professional advice or recommendations.

By using this website, you acknowledge and agree to these terms. We reserve the right to modify this disclaimer at any time without notice.